Fake Checks (and how to avoid them)

June 01, 2019

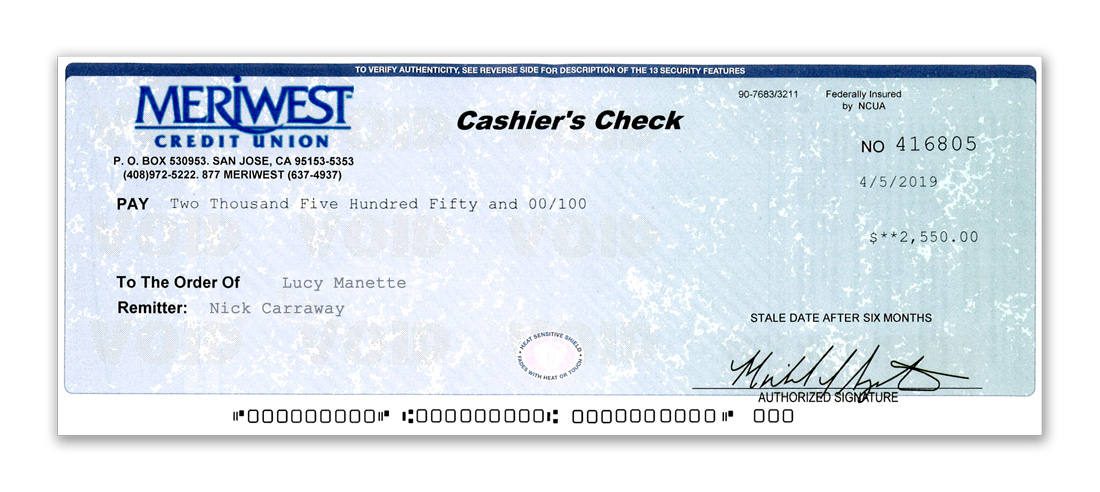

The Federal Trade Commission, the nation’s consumer protection agency, wants you to know that counterfeit check scams are on the rise. Some fake checks look so real that even bank tellers can’t tell the difference. This is because scammers use high quality printers and scanners to make the checks look real. Some checks even contain authentic-looking watermarks. Although these checks are printed with the names and addresses of legitimate financial institutions, as well as existing bank information such as account and routing numbers - the check still can be a fake. These fakes come in many forms, from cashier’s checks and money orders to corporate and personal checks.

Fake Checks: Variations on a Scheme

There are a growing number of fraudulent schemes based around counterfeit or fake checks. The most common schemes tend to involve: foreign lottery scams, check overpayment scams, internet auction scams, and secret shopper scams.

Here’s a classic example of a fake check being used. A scam artist responds to a classified ad or auctioning post, offering to pay for an item with a check. Seems innocent, until the scammer comes up with a reason for writing the check for more than the asking price. To correct the “mistake” the scam artist asks the seller to wire back the difference after depositing the check. The seller agrees, and later finds out the scammer’s check bounces – leaving the seller liable for the entire amount.

Another example is the secret shopper scams. A consumer is hired as a secret shopper, unknowing that they are being tricked. They are asked to evaluate the effectiveness of a money transfer service by being handed a check and told to deposit it into their bank account. Next they are asked to withdraw the amount in cash and use a money transfer service to send the funds to a person in a Canadian city. Then, they are asked to evaluate their experience – however, no one is collecting the evaluation, as this was just a scam to get the consumer’s money. Below is an example of a recent counterfeit bank check which was presented at North Shore Bank – looks pretty legit, doesn't it?

You and Your Bank — Who is Responsible for What?

You and Your Bank — Who is Responsible for What?

Normally, Banks make funds available to you a business day after you deposit the check – it’s the law. These funds may come from U.S. Treasury checks, most other governmental checks, and official bank checks (cashier’s checks, certified checks, and teller’s checks). However, for other checks, banks make the first $200 available the day after you deposit the check and the remaining amount the second business day. Despite seeing the money in your account, you must remember that it doesn’t always mean the check is good. Until the bank has cleared the check, it is best not to rely on these funds – unless of course they are coming from a trusted source.

Protecting Yourself

Here are a few tips to best avoid a counterfeit check scam:

- Throw away offers that require you to pay for a prize. Remember, if it’s a free gift, you shouldn’t have to pay. Free is free.

- Resist the urge to enter foreign lotteries, especially through mail or the phone – that’s illegal and most likely phony.

- Never wire money to strangers.

- If you are selling something, make sure you don’t accept a check higher than the selling price – no matter how convincing the reason is. If they refuse to send the correct amount, then return the check and don’t send the merchandise.

- As a seller, you can suggest an alternative way for the buyer to pay, like an escrow service or online payment service. If the buyer insists on using a particular payment service, do your research and read its terms of agreement and privacy policy. Even try calling the customer service line. If there isn’t one or if you call and can’t get answers about the service’s reliability — don’t use the service.

- If you normally accept payment by check, ask for a check drawn on a local bank. This will allow you to make a personal visit to ensure its legitimacy or you can call the bank where the check was purchased and ask if it’s valid.

- If the buyer insists that you wire back funds, terminate the transaction immediately. Legitimate buyers won’t pressure you to send money back by wire transfer services.

- Avoid the call to action “act now.” If the buyer’s offer is good now, it should be good after the check clears.

If You Think You’re a Victim

If you think you’ve been targeted by a counterfeit check scam, report it to the following agencies: The

Federal Trade Commission, The

U.S. Postal Inspection Service, or your state or local consumer protection agencies. Visit

www.naag.org for a list of state Attorneys General.

Source: Federal Trade Commission Consumer Information:

“Fake Checks”